An Unbiased View of How Does Medicare Part D Work

Wiki Article

What Does Boomer Benefits Reviews Do?

Table of ContentsThe 7-Second Trick For Medicare Supplement Plans Comparison Chart 2021 PdfSome Known Questions About Medicare Supplement Plans Comparison Chart 2021 Pdf.All About Apply For MedicareSome Known Details About Apply For Medicare

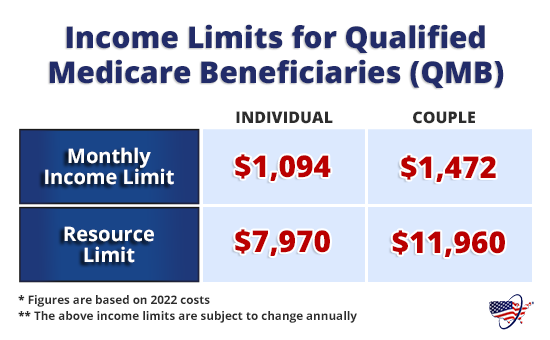

Usage Approach B for earnings and also properties. Keep in mind: If people who are also qualified for MA meet even more than one basis of eligibility, they might pick one of the most beneficial basis for MA, yet must make use of an Approach B basis for the Medicare Financial Savings Program. Possession Guidelines Possession limitation is: l $10,000 for a family of one.

Example: Bud's income is 125% FPG. He is disqualified for QMB also if he has covered costs that would certainly permit him to spend down to 100% FPG. The benefits of the QMB program are: l Settlement of Medicare Part An and also Component B premiums. medicare supplement plans comparison chart 2021 pdf.

It is seldom useful for people in LTC to be QMB-only because: l Medicare Part A covers very restricted competent nursing care. l Payment might not be verified until a number of months after the care is received. If you know Medicare Part A is covering any of the LTCF costs, it is advantageous for people to be QMB-only since there wouldn't be an LTC spenddown.

The Best Guide To Medicare Select Plans

People might qualify for MA and also QMB concurrently. l People with revenues at or under 100% FPG qualify for QMB, as well as likewise for MA without a spenddown if their properties are within MA restrictions. l Since QMB permits a standard $20 revenue negligence and MA does not, people with incomes over 100% FPG however no even more than 100% FPG + $20 are within the QMB income restriction but have to satisfy a spenddown to qualify for MA.

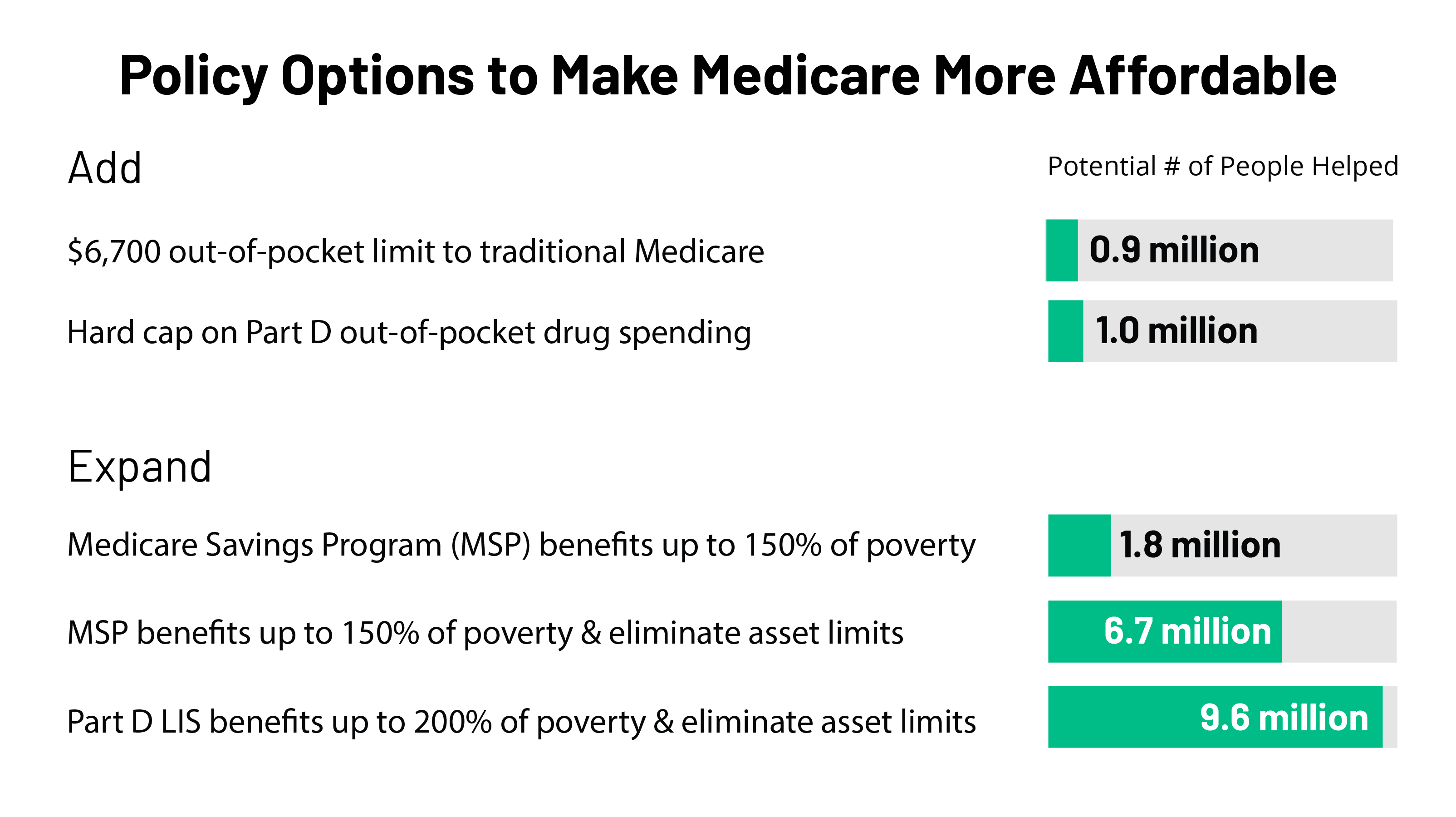

Medicare Savings Programs (MSP) help people with restricted earnings and also resources pay for some or all of their Medicare costs and might additionally pay their Medicare deductibles and co-insurance. There are 4 various types of Medicare Savings Programs, this page focuses on the Qualified Medicare Beneficiary (QMB) Program.

Unknown Facts About Medicare Part G

How To Apply Where Do I Get These Services?You can also check out the Medicare web site to browse for Medicare service providers. If you have much more concerns regarding this program please see our Medicare/Medicaid Frequently Asked Questions or call our Participant Contact Facility. Program Get in touch with: , 303-866-5402. The member's benefits are restricted to repayment of the member's Medicare Part B premium only. Companies must tell the member that the service is not a Medicaid-covered solution for a member that has only SLMB protection. When the EVS identifies a member as having just Specified Low Revenue Medicare Recipient insurance coverage (without also having Complete Medicaid or Plan An insurance coverage), the provider should speak to Medicare to confirm clinical protection.

When the EVS determines a participant as having Defined Low Income Medicare Recipient protection and also Complete Medicaid or Package A protection (without waiver liability), Medicaid claims for services not covered by Medicare needs to be submitted as regular Medicaid cases and also not as crossover insurance claims. The participant's advantage is settlement of the participant's Medicare Component B premium.

The participant's benefit is payment of the member's Medicare Part A costs. The EVS identifies this protection as Competent Medicare Recipient - medicare part g.

8 Simple Techniques For Medicare Select Plans

Annual modifications in the FPL imply that, also if you could not have actually gotten QMB in 2014, under the brand-new FPL, you might be able to certify this year. To use for the QMB program, you will certainly require to call your neighborhood state Medicaid workplace. For more support, you might want to call your neighborhood State Medical insurance Support Program (SHIP) - medicare supplement plans comparison chart 2021.

SPAPs are state-funded programs that offer low-income as well as clinically clingy elderly people and individuals with impairments monetary assistance for prescription medications. boomerbenefits com reviews. We have SPAP details online below (note that the SPAP details goes through alter without notification): If you do not satisfy the low-income financial requirements to get the QMB program, you still might have several of your Medicare prices covered by among the various other Medicare Financial Savings Programs.

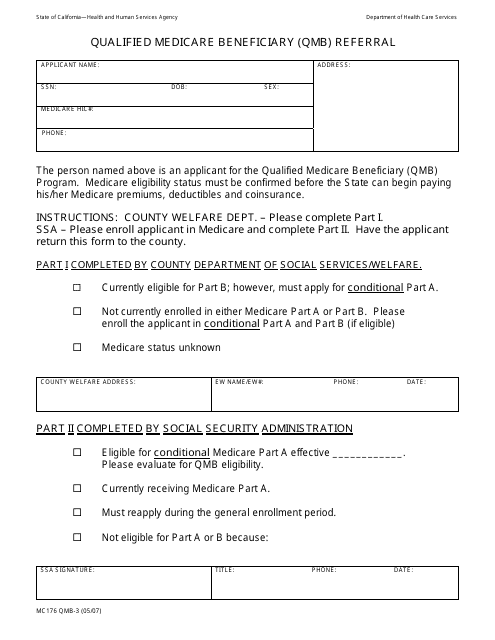

Example of see this individual requesting Premium-Part An and Component B registration during a registration period: Ms. Adler stays in Pennsylvania (a Part A Buy-In State) and also does not have Medicare. She calls her local FO in January 2018 because she wants Medicare coverage however can not afford the premiums.

Adler might submit an application for "conditional registration" in Premium-Part A. Since Ms. Adler stays in a Component A Buy-in State, the Part B as well as conditional Part A registration can be submitted any time. The application is not processed as a General Registration Duration (GEP) application. The FO takes the application as well as processes it according to instructions in HI 00801.

Report this wiki page